Marriott Harrison is a legal transactional and advisory firm, best known for its market-leading work alongside ambitious entrepreneurs and insightful investors who build, evolve, and monetise globally successful companies. From its base in London, its multi-disciplinary team manages transatlantic and pan European work, often involving the world’s top-tier technology investors.

GP Bullhound announced the winners of the 21st annual Allstars Awards on October 19, held at Outernet. Over 400 of the most distinguished names from Europe’s tech and investment scene gathered to celebrate the sector’s resilience, with broadcast journalist and author Clare Balding taking to the stage to open the event. Winners across 14 categories were celebrated, ranging from Entrepreneur of the Year to Tech4Good, further showcasing the diverse talent and innovation that characterise the European tech landscape.

Check out some of the event highlights below.

Celebrating the successes and achievements within Europe’s tech universe

Allstars recognises and celebrates the successes and achievements within Europe’s technology universe, drawing attention to those who are shaping the industry’s future and creating the global winners of tomorrow.

Dubbed the ‘Oscars of the tech world’ Allstars has stood strong as one of Europe’s leading events for the last 21 years.

Winners were announced at the Allstars Awards ceremony on 19 October 2023.

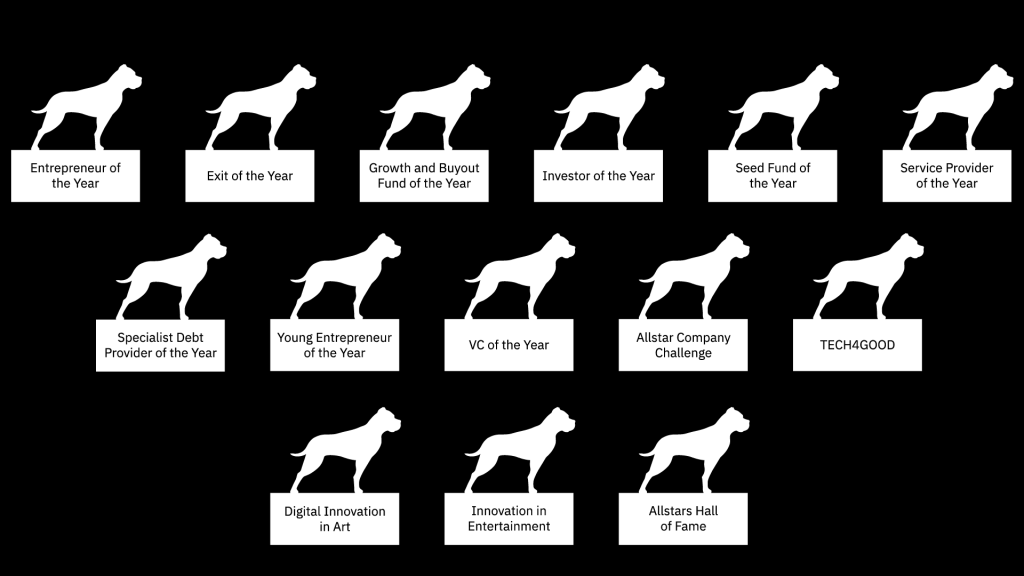

Allstars Awards Categories 2023

Winners 2023

Winners 2022

Entrepreneur of the Year – Front App

Investor of the Year – Partech Partners

Young Entrepreneur of the Year – Co-founder & CEO of Formo

Investor Allstars Hall of Fame – Co-founder at Phoenix Court Group

Entries open until 6 June 2023

GENERAL

The Investor Allstars Awards are initiated and organized by GP Bullhound LLP.

ENTRY PERIOD

Entries are open between 25 April 2023, 1PM BST and 6 June 2023, 11PM BST.

CATEGORIES

There are 13 categories, of which you that you can enter 12 categories. See all categories here.

WHERE TO ENTER

You can submit your entry online via the entry forms. Please note, that we are not able to accept entries via email or mail. All entries must be submitted in English. Please ensure you read the criteria for the awards you are entering. Remember to use evidence such as figures (amounts invested, AUM) and include as much information as possible in your entry form. The organizers do not accept any responsibility for loss or damage of any entry. Make sure that all information and figures are correct before submitting the entry. Once the form is submitted, you won’t be able to go back and edit your entry. To make changes or additions after you have submitted the entry form, please contact investorallstars@gpbullhound.com.

ELIGIBILITY

Entries must relate to achievements/work undertaken in the period between 15 April 2022 – 15 April 2023. The awards are open to open to all registered companies, as well as all individual investors and entrepreneurs over the age of 18. Entrants can enter as many more than one category if applicable and they match the criteria.

CONFIDENTIALITY

All material will remain confidential to the GP Bullhound (which will include its directors and employees) and appointed judges. All judging discussions are confidential and will not be shared or discussed with anyone outside of the judging panel ahead of the award ceremony or thereafter. Judges will not share confidential material, judging material or entries with anyone. All judging materials will be securely deleted immediately after the judging period.

DATA STORAGE

By entering for the Investor Allstars Awards, you agree that we will store and process the entry materials, as well as the personal information submitted on our database. Your data will be only accessed by GP Bullhound employees as well as the appointed Investor Allstars judges. Any personal data and will be dealt with in accordance with our privacy policy.

JUDGES

The judging panel is made up of some of the most high-profile investors in Europe. Names, biographies and portraits of jury members are public on the judges’ section on the Investor Allstars website. GP Bullhound will select and manage the Investor Allstars judging panel, which will be instructed to act without bias or favour. If a judge faces a potential conflict of interest, they will be assigned to a different category. The judges’ decisions are final and no correspondence will be entered into regarding their decisions or decision-making processes.

SHORTLIST & WINNERS

Shortlisted entries will be published on www.investorallstars.com. Entrants who were shortlisted will be notified via email from GP Bullhound. Investor Awards 2022 winners will be announced during the award ceremony on 19 October 2023 at HERE at Outernet in London.

LIABILITY

GP Bullhound LLP reserves the right to cancel or amend Investor Allstars Awards and these terms and conditions at any time. GP Bullhound LLP will not be liable to entrants for any consequential losses (i.e. loss of revenue, loss of business, loss of goodwill, loss or damage to data or information) arising out of, or in connection with, the provision of the service of publishing your participation on the Investor Awards website.

AWARD CEREMONY & TABLE BOOKINGS

The 21st Allstars Awards will take place on 19 October 2023 at the HERE at Outernet in London

For table bookings, please contact jade.williams@gpbullhound.com or investorallstars@gpbullhound.com

Partner – GP Bullhound

Alexis has broad experience across the technology industry and has led successful M&A transactions in sectors including software, IT services, telecoms, internet and digital media.

Prior to joining GP Bullhound, Alexis was Director of corporate development at Experian where he was responsible for deal origination and execution for the EMEA region. He previously spent more than 10 years working in the technology sector and held international Corporate Development roles at HP Enterprise Services and EDS, where he worked on numerous acquisitions and divestments across Europe.

Alexis holds a BSc Joint Hons. in International Management and Modern Languages from the University of Bath and an MBA from Imperial College Business School.

Ali Ramadan is a Technology partner at Goodwin. He has broad corporate experience and a practice that spans the corporate life cycle. In particular, Ali focuses on venture capital, cross-border M&A, and private equity transactions for technology businesses. His clients include start-ups, high-growth companies and investors (both institutional and corporate) operating in the technology, fintech, proptech, and digital media industries.

Partner – GP Bullhound

Alon is a Partner at GP Bullhound’s growth fund, responsible for originating investment opportunities and handling portfolio companies globally.

Prior to GP Bullhound, Alon worked at Silver Lake Partners, Atomico and Bank of America Merrill Lynch.

Alon graduated from the London School of Economics with a First Class Honours.

Partner – EQT

Carolina joined EQT Partners in June 2020, based in London, where she is a part of the Growth team that partners with growth stage companies and management teams.

Prior to EQT, Carolina was a Partner at Softbank Vision Fund, where she invested in Growth stage companies globally, and prior to that, Carolina invested at Series A and B as a Partner at Atomico. Some of her recent investments include Behavox, Gympass, Hinge Health, Rekki, Ontruck, Memphis Meats and Farmdrop.

Previously, Carolina has worked as Head of Ops to a now defunct gifting e-commerce start-up, as an investor at Chicago-based private equity firm Madison Dearborn Partners and within Consumer/Retail Investment Banking at Merrill Lynch in New York.

Carolina has a Bachelor of Science degree in Foreign Service from Georgetown University and an MBA from Columbia Business School. She is originally from Brazil.

Partner – Orrick

Chris Grew, a partner in Orrick’s London office, is a member of the Technology Companies Group, which advises high growth technology companies and venture capital firms. Chris joined Orrick in 2008.

Chris advises technology companies in venture capital transactions, public offerings and cross-border mergers and acquisitions. He regularly advises high technology (particularly Internet and computer software and hardware) companies with respect to their international business operations and transactions, as well as investment banks, venture capital firms and other financial intermediaries that serve technology companies

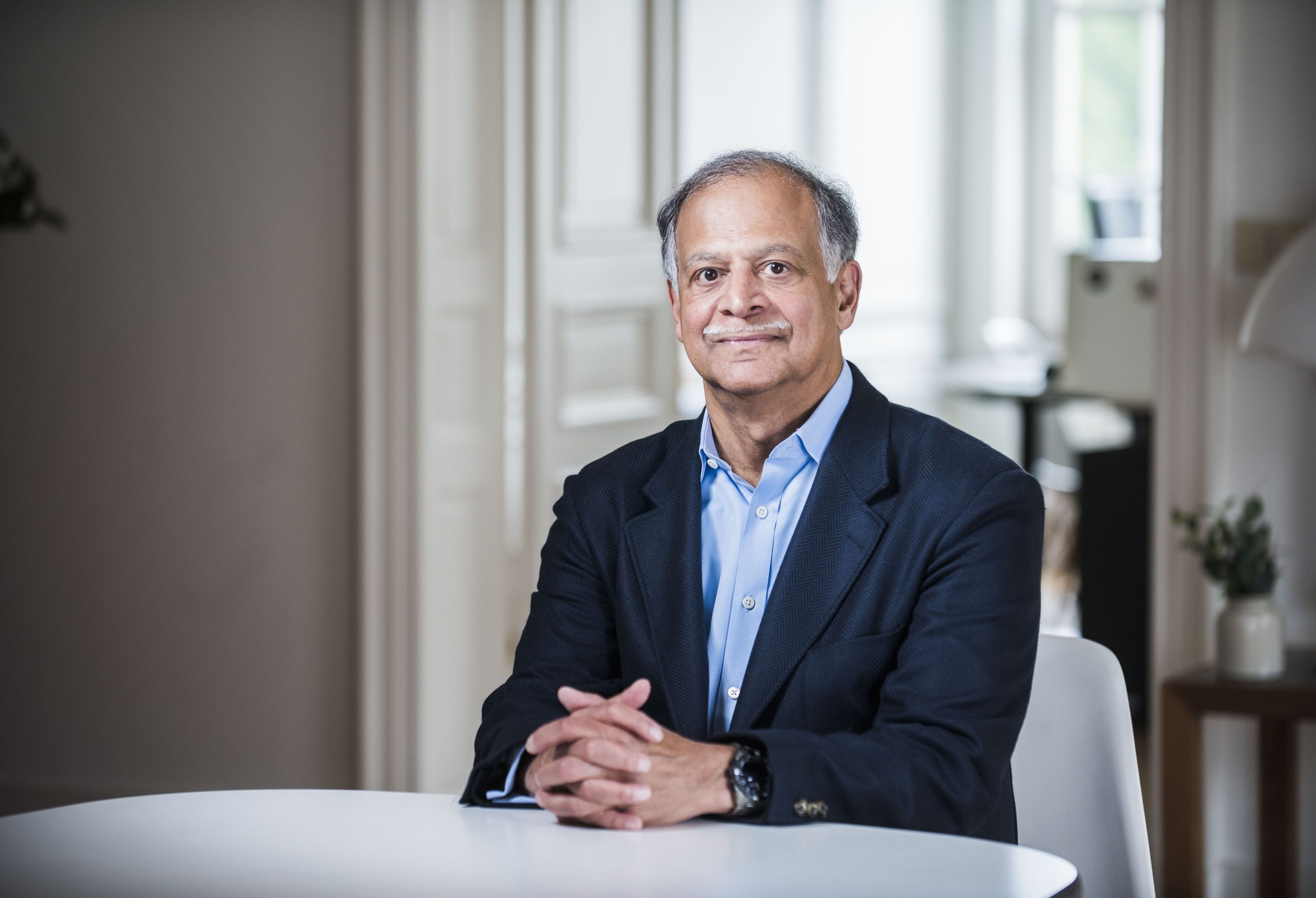

Partner – Marriot Harrison

David is a partner and the head of Venture Capital at Marriott Harrison, responsible for the delivery of strategic leadership and advice to the firm’s client base of top-tier European and US investors and high growth companies.

Recognised as a leading UK venture capital specialist, David is a regular speaker, commentator and contributor to key industry events and publications and a member of the BVCA committee for early-stage investment model documents.

Partner and Co-President

Deep Shah is a Partner and Co-President of Francisco Partners, and is based in the firm’s London office where he jointly leads European investment activities as well as managing the investment team operations globally. Prior to joining Francisco Partners in 2003, Deep held a range of roles at Morgan Stanley within both their Investment Banking and Private Equity groups. Deep currently serves on the board of directors of BluJay Solutions, ByBox, EG Software and MetaSwitch Networks. He previously served on the board of Attenti, Click Software, C-MAC MicroTechnology, eFront, Ex Libris, Lumata, Masternaut, NexTraq, Operative, Prometheus Group and Smartfocus while being involved in a number of the firms other investments.

Partner – AlbionVC

Ed is a Partner at AlbionVC where he leads the tech investing, focusing on early stage software and deeptech investments.

Aside from investing Ed also plays keyboard in the Allstars band. Ed started his career at ING Barings, working with public companies during the dotcom boom and bust”.

Partner – Endeit Capital

Ilan is a partner at Endeit Capital, a venture capitalist with offices in Amsterdam, Hamburg and Stockholm. Recent investments include IPRally, Amberscript, Stravito, Parcellab and TourRadar.

He is currently board member at Virtuagym, a B2B SaaS technology scale-up for the fitness & corporate wellness industry. Ilan was previously on the board at Hubs, a leading automated on demand manufacturing platform, which was exited to Proto Labs.

Ilan was an advisory board member of the Interactive Advertising Bureau Netherlands, mentor at the accelerator Startupbootcamp in Amsterdam and is co-founder and former board member of VEECEE, the foundation for European venture capital professionals.

Prior to Endeit, Ilan was CFO and business development director at an international media tech startup. He holds an honours Master in Commercial and M&A Laws from the University of Amsterdam and completed graduate courses in law and business during an exchange program at the University of California in Berkeley.

Co-Founder of Astanor Ventures

George Coelho is Co-Founder of Astanor Ventures, an investment manager specialized in FoodTech venture finance. Previously he was Chairman of Octo Telematics, Ltd. Coelho also co-founded the European arm of Benchmark Capital, now known as Balderton Capital, a leading venture capital firm. Before Benchmark, he was a founder of Intel Capital, the strategic venture capital arm of Intel Corporation.

Coelho has wide investment experience ranging from early-stage start-ups to public companies and has been involved in more than 100 investments worldwide. Sample transactions where he has been an early investor include: Broadcom and Citrix (US), PCCW (China), Trend Micro (Japan) and Betfair, LoveFilm and ZOPA (UK). Coelho has successfully brought companies to flotation on stock exchanges throughout the world, which today represent over $100 Billion in market capitalization.

Coelho holds a B.S. from The American University and an MBA from The George Washington University. He has been a Trustee of The George Washington University (2008-2016) and was on the Council of the School of Business and The Corcoran School of the Arts & Design. Currently he is on the Board of Human Rights Watch and The American Air Museum in Britain. He is also a lifetime Fellow of the RSA. In 2011 he was awarded the Polish State medal, Pro Memoria.

Co -Founder and Managing Partner – Calibre One

James manages the firm’s activities in the EMEA region, based in London. With over 20 years of experience, his major focus has been on recruiting at Board and C-level for businesses headquartered in Europe. He works closely with the private equity community and is a trusted advisor to a number of funds.

He has also managed a vast number of leadership assignments for US companies across the EMEA region. Outside of work he is an active angel investor in tech companies, a parent to twin boys and an avid sports enthusiast (anything, but especially golf and rugby).

Managing Partner – Ventech

Jean Bourcereau joined Ventech in 2000. As a General Partner, he has spent two decades helping management teams scale B2B businesses from pre-revenue to market-defining.

An engineer with a global background in Telecommunications (AT&T Bell Labs, Telecom Argentina), Semiconductors, and IP Networks (Altran Group), Jean has facilitated successful exits for Altitude Télécoms (ILD), Arteris (QCOM), Ateme (ATEME), Ekinops (EKI), Musiwave (MSFT), Muzicall (RNWK), Wengo (VIV) and Withings (NOK).

Jean is based in Paris and holds an engineering degree with a major in Physics from Ecole Polytechnique and Télécom Paris.

Chief Investment Officer – Beringea

Karen is Chief Investment Officer at Beringea, responsible for making new investments and working with portfolio companies through to exit. Her investments include Watchfinder, Thread, Fnatic, Monica Vinader, and MatsSoft amongst others.

Karen was previously with the Boston Consulting Group and ran the Watch division of Swiss Army. She holds an MBA from INSEAD and a BSBA from Boston University.

Managing Partner, IQ Capital

Kerry co-founded IQ Capital in 2006 and is one of the UK’s most experienced VC investors with over 20 years deep-tech venture capital experience. She joined Venture Technologies in 1998, investing in the first wave of UK deep-tech companies and has focussed on deep tech early-stage technology over her five funds which invest from seed to £30m to portfolio outperformers.

Kerry specialises in GTM, Strategic Marketing, Competitive Intelligence and heads up IQ’s cybersecurity, supervisory and reg tech, big data and neuro-tech portfolio. She sits on several boards and has conducted several exits and IPOs.

She is known as a contributor to best practice in venture capital, from ESG and a 2018 in-depth study on Investment Committee best practice and decision making across Private Equity and Venture Capital. She is the Chair of the British Private Equity and Venture Capital Association (BVCA), a Fellow in Entrepreneurship at the University of Cambridge (Judge Business School) and Board Advisor to All Party Parliamentary Group for Entrepreneurship.

Co-Founder and Managing Partner – GP Bullhound

Manish Madhvani is Co-Founder and Managing Partner of GP Bullhound. Manish has executed M&A and capital raising transactions since 1997, involving some of the best known global internet, software and media companies, including: Spotify, King.com, Believe Digital, WPP, Wipro, Fjord, Hearst Corporation, Accenture, Newscorp and Experian.

Manish who was selected as one of the top 40 dealmakers globally by M&A Advisor, started his career at Barclays Capital’s Private Equity team. He has advised the Treasury on Entrepreneurship and graduated from Southampton University with an LLB in Law / MA in Marketing.

Manish is a regular speaker on Bloomberg and CNBC and is currently an Ambassador for London Technology Week. He was recognised as one of the leading Entrepreneurs in the UK by the Sunday Times / Maserati 100.

Partner – TCV

Mike is a Partner in TCV’s London office and has been with the firm for 8 years. He splits his time between SaaS, fin tech and consumer technology. His current investments include Revolut, Redis, Qonto, Trade Republic, Believe (Euronext Paris: BLV), Miro, Mambu, FlixMobility, SuperVista, Sportradar (Nasdaq: SRAD).

Actress, filmmaker

As an actress, Mika has worked on a diverse range of creative projects including the BAFTA-winning Falling Apart, Film London’s Balcony which won the Crystal Bear award at the Berlin Film Festival and BFI nominated Dictynna Hood’s Us Among the Stones in 2019. In 2021 Mika played in BBC’s Showtrial and most recently at The Park theatre London in Andrew Steins play Disruption about the impact of a rogue AI algorithm on human lives.

Mika’s directorial debut, Rain Stops Play, won the Silver Remi for best comedy at Houston World Film Festival and has been nominated at BAFTA qualifying Underwire Festival and CBFF. She was named as Best International Director for her second short film Breach at Portland Comedy Festival, which premiered at BAFTA qualifying BUFF in November 2021. In 2023 she premiered her third film My Week With Maisy starring Joanna Lumley which is now in competition.

When not working as an actress or making films, Mika hosts The Happy Vagina podcast which empowers women through inspirational content that both educates and entertains, as seen on Fabulous Magazines ‘graph of greatness’ was Marie Claire’s 2020 ‘next must listen’. In response to the success of the podcast, The Happy Vagina book will be published by Harper Collins in May 2022.

As a Women’s health activist, Mika is also co-founder of the Lady Garden Foundation, one of the world’s leading Gynaecological charities, and co-chair of the Ginsburg Women’s Health Board, an independent advisory board supporting better diagnosis in Women’s health.

In 2021 Mika was Harpers Bazaar’s Female Visionaries and YOU Magazines’ Women of the Year.

General Partner -HV Capital

Rainer has been a member of the HV Capital team since 2008. He was responsible for the firm‘s investments in Zalando (IPO 2014), Quandoo (sold to Recruit in 2015), Stylight (sold to Pro7 in 2016), HelloFresh (IPO 2017), Home24 (IPO 2018) and brands4friends (sold to eBay in 2010) and led investments in Scalable Capital, finn.auto, Dance, Outfittery, Alasco and many others.

Before coming to HV, Rainer played an entrepreneurial role as Head of Business Development at 123people.com. The business was sold successfully to Pages Jaunes in 2010. Prior to that, Rainer worked for five years in the venture capital field at 3i and Siemens Acceleration. Rainer started his career in a tech role at Siemens in 2000.

Rainer studied Electrical Engineering at the Technical University of Munich and received his MBA at INSEAD, graduating both with honors. He is a family guy, loves the outdoors and endurance sports, participated in the Ironman World Championship in Hawaii and many other events.

Partner – Connect Ventures

Rory is a Partner at Connect Ventures, a thesis-led venture capital firm based in London and investing across Europe. Connect leads seed investments in purpose-led founders, obsessed with solving hard problems at scale, by creating products and companies that people love. Rory is passionate about technology, entrepreneurship and leadership development, and has spent the majority of his career working in start-ups and venture capital. Prior to Connect he was a partner at MMC Ventures and a co-founding partner at BGF Ventures. He’s invested at seed, series A and series B stage, in both B2B and consumer software companies. He now spends most of his learning and investing in fintech.

Managing Director – CVC

Sebastian joined CVC in 2012 and is a member of the CVC Telecommunications, Media & Technology team and CVC Growth Partners.

Prior to joining CVC, he worked for Francisco Partners and UBS Investment Bank.

Sebastian studied at Boston College and the University of Glasgow, where he graduated with a first class MA in Business and Management. Prior to University, Sebastian served in the German military.

Partner – Wilson Sonsini Goodrich & Rosati

Stacy Kim is a leading American cross-border technology lawyer, strategic business advisor, and a co-founding partner of Wilson Sonsini Goodrich & Rosati’s London office.

Stacy advises technology and life sciences companies at all stages of the corporate life cycle (including formation, U.S. “flips,” financings, collaboration/joint ventures, and exits); and leverages the Wilson Sonsini platform to help companies and investors compete and win on the global stage. She supports companies in diverse industries such as agritech, AI, digital media, fintech, IOT, life sciences, semiconductor, and software, as well as the venture capital firms that invest in these companies.

Stacy is passionate about advancing women in technology in the UK by collaborating with and sponsoring certain events, including her mentorship activities with Blooming Founders and Declare.

Will joined LGT in 2008 having spent 15 years in the wealth management industry. He is a Partner and focuses on high net worth clients who require a broad range of wealth structuring and investment solutions.

Premium Sponsors

At Goodwin, we partner with our clients to practice law with integrity, ingenuity, agility, and ambition. Our 2,000 lawyers across Europe, the United States and Asia excel at complex transactions, fund formation, high-stakes litigation and world-class advisory services in the technology, life sciences, private equity, real estate, and financial industries. The firm’s unique combination of deep experience serving both the innovators and the investors in a rapidly-changing, technology-driven economy sets Goodwin apart. To learn more, visit, us at www.goodwinlaw.com and follow us on Twitter, LinkedIn and Instagram.

LGT Wealth Management UK is part of the global private banking and asset management group LGT, owned by the Princely Family of Liechtenstein. When we set up our business in 2008, our aim was to offer a fresh approach to wealth management. We put our clients first by providing a transparent service, designed around what is right for each of them.

Our entrepreneurial approach, together with the wider LGT Group’s stability, enables us to make decisions that we believe will provide long-term benefits for our clients. This flexibility allows us to tailor our business model to suit our vast range of client types and the unique requirements that they have, be it private clients, institutional clients, financial intermediaries or international clients.

Orrick is a global law firm focused on serving three sectors driving the global economy: technology & innovation, energy & infrastructure and finance. Founded more than 150 years ago in San Francisco, Orrick today has offices in 25+ markets worldwide. Innovation inspires us. That’s why Financial Times selected Orrick as the Most Innovative Law Firm in North America for a remarkable three years in a row. Fortune ranks Orrick in its 2020 list of the 100 Best Companies to Work For (five years in a row) and Law360 ranks us in its Global 20 list (eight years in a row).

Wilson Sonsini Goodrich & Rosati is the premier legal advisor to technology, life sciences, and other growth enterprises worldwide. We represent companies at every stage of development, from entrepreneurial start-ups to multibillion-dollar global corporations, as well as the venture firms, private equity firms, and investment banks that finance and advise them.

Awards Sponsors

.ART is the internet domain for the world’s art and creative community. Launched in 2016, .ART is one of the fastest-growing top-level domains for creatives, with more than 250,000 domains registered to date. In 2019, .ART launched “Digital Twin” to securely archive art and cultural object metadata. As part of the company’s ongoing philanthropic activities, a portion of .ART’s revenue goes to support the charitable Art Therapy Initiative. .ART’s global team across London, Beijing, Los Angeles, and Washington D.C. shares the mission to bring technology and art together, creating a digital infrastructure for the international creative community.

For more information, visit www.art.art.

Bird & Bird is an international law firm with a focus on helping organisations being changed by technology and the digital world. With over 1300 lawyers in 29 offices across Europe, the Middle East and Asia-Pacific, we’re ready to help you wherever you are in the world.

Established in 1999, Calibre One is a leading, international Executive Search organisation based in San Francisco, London, New York, and Singapore.

We help some of the world’s most successful companies – from iconic giants to VC backed market pioneers – to build relationships with the world’s most talented people.

We specialise in managing high-level executive searches for software, hardware, business services, communications, cleantech and internet businesses and we work with leading investors in North America, Europe, Asia Pacific, Latin America, and Israel.

Clients partner with Cooley on transformative deals, complex IP and regulatory matters, and high-stakes litigation, where innovation meets the law. Cooley has 1,100+ lawyers across 16 offices in the United States, Asia and Europe.

HSBC Innovation Banking UK provides commercial banking services, expertise and insights to the technology, life science and healthcare, private equity and venture capital industries. HSBC Innovation Bank Limited is a subsidiary of HSBC Group, benefiting from its stability, strong credit rating and international reach to help fuel its growth.

Mishcon de Reya is an independent law firm, which now employs over 1300 people with more than 630 lawyers offering a wide range of legal services to companies and individuals. The firm has grown rapidly in recent years, showing more than 40% revenue growth in the past five years alone.

With presence in London, Oxford, Cambridge, Singapore and Hong Kong (through its association with Karas So LLP), the firm services an international community of clients and provides advice in situations where the constraints of geography often do not apply.

As an integral part of the investment ecosystem, Mishcon de Reya forges close partnerships with companies and investors. In the previous year alone, Mishcon de Reya played a pivotal role in facilitating and advising on investments totalling over £1 billion. The firm supports founders in building their businesses while assisting investors seeking new opportunities.

The work the firm undertakes is cross-border, multi-jurisdictional and complex, spanning six core practice areas: Corporate; Dispute Resolution; Employment; Innovation; Private; and Real Estate.

By blending its global presence, talent, and commitment to its clients, Mishcon de Reya remains at the forefront of the corporate legal landscape.

As one of one of the premier firms for venture capital transactions Taylor Wessing act for many of the most high profile investors – from the prominent early stage funds and the biggest international venture capital firms to corporate investors and sovereign wealth funds –as well as many of the most successful early and growth stage investee companies across Europe.

2023 Charity

Allstars is proud to support Working Options in Education. Working Options in Education helps young people fulfil their potential by developing employability and life skills. Our Career Pathways Programme, delivered free with state schools and colleges, supports young people facing additional challenges caused by the pandemic, prioritising those from disadvantaged regions.

The programme includes self-directed online learning; employability and skills masterclasses; talks from industry volunteers; mentoring; business challenges; and access to work opportunities in partner companies.

Since 2010, we have worked to transform the life chances of young people (14-19), by helping them take early control of their education or career journey, when the choices they make will shape their future.

Allstar Company Challenge Presenting Companies

Armando is a technology entrepreneur and the CEO and Co-founder of RavenPack, the leading provider of big data analytics for financial institutions. At RavenPack, he oversees all product design and engineering of the company’s data products and analytical tools. Armando is a recognized expert in applied big data and artificial intelligence (AI) technologies. He is widely regarded as one of the most knowledgeable authorities on systematic data analysis in finance. He is a recognized speaker at academic and business conferences across the globe. Armando holds degrees in Economics and International Business Administration from the American University in Paris. As a thought leader, his commentary and research has appeared in leading business publications such as the Wall Street Journal, Financial Times, among many others.

Digital technology has characterized Carlo De Matteo’s career since his beginnings in London, where he initially worked in law firms specialized in media and IT. From 2002 to 2008 at Hewlett-Packard, he managed the marketing in-housing strategies, first in EMEA and then globally. In 2008 he met Andrea Pezzi, with whom a very productive professional partnership was born. First he held the role of General Manager of OVO, an encyclopedic documentary videos platform, and he became a partner and co-founder of TheOutplay in 2010 and MINT in 2014.

A profound connoisseur of the digital industry, he is the creator of the products and processes that have given shape to the innovative MINT proposal: a platform that integrates and automates the processes and technologies of digital advertising allowing for a true transformation of the industry.

Born in 1973, Carlo De Matteo graduated in Law from the State University of Milan and subsequently received a Master’s degree in Media and Technology from the European School of Advanced Studies. Since 2017, he has joined his entrepreneurial activity with his academic activity at the University of the Union of the Chambers of Commerce, where he teaches the first course in Digital Economy in Italy.

Gareth is an experienced Chief Executive Officer with a demonstrated successful track record of growing and transforming software and services businesses. He has a deep understanding of technology, digital transformation, and commercialization of IP, and is an experienced executive working with Private Equity sponsors.

“Making profits is not a purpose of business. It’s a derivative. A purpose is what problems it is solving for us as customers and communities.” – Colin Mayer

Anton Pavlovsky is the Founder & CEO of Headway, a global EdTech startup with Ukrainian roots and an emerging unicorn. In just four years, Headway has grown into an ecosystem of microlearning products with over 60 million users, a team of 150+ people, and offices in London, Kyiv, Warsaw, and Nicosia. In 2023, Headway was recognized by GP Bullhound as “Europe’s Next Generation” — one of the top 50 companies with the most potential to become billion-dollar companies in the next two years, and by Global Silicon Valley as “GSV 150” — one of the world’s most transformative digital learning and workforce skills companies. The company’s flagship, the Headway app, is the world’s most downloaded book summary app, with over 25 million users and the Editor’s Choice award from the Apple App Store. Anton is a serial entrepreneur who loves to launch and scale startups, develop digital products that impact the market, and build teams with a cohesive culture. Before Headway, he founded a startup in the social discovery space and, as the CPO, built an embryonic startup into the #1 in its market. Anton advocates for lifelong learning and is passionate about self-improvement and the doors it can open.

Karsten Boehrs is an experienced management executive with a track record of more than 25 years in major enterprises. He worked for international eCommerce and media companies in C-level positions focused on sales, operations, and digitalization, held responsibility for thousands of employees and took leading roles in business development, joint venture, M+A and restructuring projects.

From 2008 on, Karsten decided to steer his career towards more personal projects and to support promising business models and companies with advice as well as venture funding.

In 2013 Karsten joined simpleshow, the market leader for explainer videos, as an investor as well as CEO. After 10 years under his lead, Karsten has managed the company to grow into the leading B2B platform for the creation of animated videos. While users can easily create their own animated videos with the help of AI-backed text-to-video technology, the simpleshow marketplace provides for professional creative services.

Karsten expanded simpleshow’s business to a range of international markets, above all the US and the DACH region, with further presence in EMEA and APAC. Large brands and multinational companies value simpleshow as a partner for simple explanation.

Matti Niebelschütz is co-founder and CEO of CoachHub, the leading global digital coaching platform, funded with over $330M from leading investors including Sofina and SoftBank Vision Fund 2, and operated by a passionate team of 600 people from over 50 nations on a mission to democratize coaching worldwide. Matti has been named Top40 Under 40 by Capital Magazine. He is a serial entrepreneur and former McKinsey management consultant with 15 years of experience in Future of Work, startups and digital business building.

Melissa Morris is the CEO and Founder of Lantum. Lantum is a workforce platform that transforms how healthcare organisations and workers connect, with a platform that simplifies rota management, staff engagement, and clinical governance for 18 ICSs, 300+ PCNs and 1-in-2 practices in the UK.

Lantum has raised in total £25 million from leading European Venture Capital firms Piton Capital and Finch Capital and employs over 100 people. They recently launched in the US, working with Cedars-Sinai Hospital in Los Angeles.

Melissa previously worked in the Strategy Directorate at NHS London. Prior to that she was a management consultant at McKinsey & Company, where she focused on transformation projects within healthcare. She is passionate about large-scale transformation in healthcare through effective workforce management and is a fellow on the NHS Innovation Accelerator, as well as an alumni of the Cedars-Sinai Innovation Accelerator.

Melissa has been featured in a number of national publications such as The Sunday Times, The Evening Standard, City AM, Sky News and was named as one of Management Today’s 35 under 35.

Allstars Shortlist 2023

We are proud to reveal the 2023 shortlist of the 21st Allstars Awards.

EXIT OF THE YEAR

ENTREPRENEUR OF THE YEAR

GROWTH & BUYOUT FUND OF THE YEAR

INVESTOR OF THE YEAR

YOUNG ENTREPRENEUR OF THE YEAR

VC OF THE YEAR

TECH4GOOD

SEED FUND OF THE YEAR

INNOVATION IN ENTERTAINMENT

SPECIALIST DEBT PROVIDER OF THE YEAR

SERVICE PROVIDER OF THE YEAR

ALLSTARS COMPANY CHALLENGE

DIGITAL INNOVATION IN ART

Sponsored by .ART

Email Address

valentina.annese@gpbullhound.com

Phone

+44 773 268 2548

Allstars 2023 Wild Card Winner

Lauren Wright, AGNP-BC- For the last 10 years, Lauren has been passionate about optimizing wellness by integrating preventative primary health care and research.

As a nurse practitioner studying the gut microbiome of preterm infants, she discovered that babies who weren’t being given breast milk were suffering fatal complications. From this gap in industry, she created a solution that would give all babies the ability to have breast milk, and support prolonged breastfeeding.

Determined to solve this problem while working as a PhD student, focused on psychoneuroimmunology and the gut microbiome , she conducted clinical research in a 4 year National Institutes of Research Study with a 99% recruitment and retention rate and simultaneously pioneered 5 years of R&D resulting in patenting an innovative infant feeding solution funded by the leading U.S. government science agency that backs NASA, and garnering support from health insurance companies and Fortune 500 industry leaders, including Johnson & Johnson.

Her leadership experience includes consulting for the fastest growing tele-health companies such as ‘For Hims & Hers’ in the top 3% of providers, as well as for Google spinout ‘Forward’, reporting to former CFO of Tesla, Jason Wheeler, on how to optimize patient care and provider operations. As CEO, she led interdisciplinary teams to successfully achieve the safest, slowest milk flow since bottles were invented 200 years ago with a capital efficient methodology after raising over half of $1 Million in grants and investments.